- support@locusassignments.com

Unit 2 Managing Financial Resources Decisions Assignment Solution

Introduction

Money is required for carrying out day to day business activities and arranging money for this purpose is called business finance. Need of business finance. Finance in business organisation is needed for establishing or bringing a business organisation into existence, to run a business and manage day to day activities i.e. working capital requirement, to expand and diversify areas and scope of business. It is very important for any organisation that is entering into any venture to know about various sources of availing and fulfilling money needs. First of all cost of availing the different sources of funds should be checked. It is also necessary to check other merits and demerits of different source of finance should also be checked.

Availability of best finance source is essential for the survival and growth of any enterprise. It also involves application of management principles. All the financial activities of a company are directly or indirectly affected by financial management and opting source of finance

Task 1

Scenario part a)

Sources of business finance

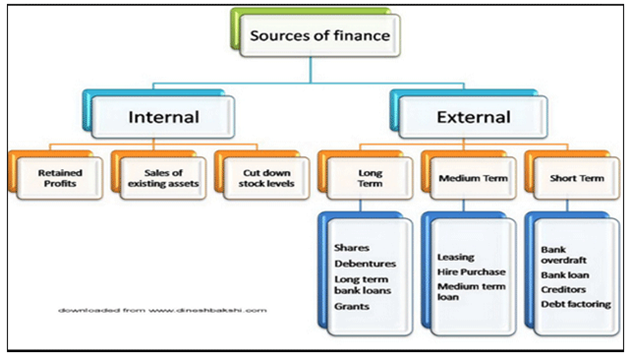

Finance sources are concerned with the production and distribution of goods and services. An organisation cannot function properly unless appropriate funds in the most appropriate cost are taken in place. The capital or funds provided by owners in the business is sometimes not sufficient to meet the requirements to business needs, the business has look somewhere else choosing other source from where needs of funds can be met in the cheapest cost and without much affecting organisational operability (Lütken, 2014).

Funds requirement take place from the day one when an owner of the business takes the decision to start the business and giving it a proper shape. Funds requirements are further grouped into two categories. These are as follows

Fixed capital fund requirements

To purchase fixed asset like land, building, machinery, furniture and fixtures it require capital from long term sources, it cannot be met from short term attainment of funds as funds required for these sources remain invested for a long horizon. Fixed capital requirement in a business depends upon nature, size and composition of business. For example we talk about concern like TESCO industries which is a diversified manufacturing organisation needs huge amount of fixed capital requirement to fulfil its machinery, land and building, transport and logistics vehicles needs. But if we talk about Barclays of Warren Buffet it requires comparative much less investment in fixed asset (Lütken, 2014).

Fund required for working capital or day to day needs

The requirement of any business ends up with attaining fixed asset only, rather it also need funds for running and meeting day to day requirement of business needs. Scalability of an enterprise effect on amount of working capital but still whether small or big every business enterprise needs it. This includes meeting out current expenses of salary & wages, rent, meeting stock requirements. However attaining goods on credit basis or current credibility of business reduces the working capital requirement of an enterprise to some extent. This is further affected by seasonal and environmental factors for example chocolates sales goes up in Christmas and New Year which tends to increase working capital requirement of nestle and Cadbury. Current capital requirements should be met from short term needs (Lütken, 2014).

(Clifford & Mohan, 2016)

On the basis of period

|

Equity Shares |

Most important source of owner’s capital. It is basic to the creation of the organisation. These are the person who has right to vote and participate in the management of the company Merits

Demerits

|

|

|

Retained earnings |

Company generally do not transfer all its profits to its shareholders members. It blocks or reserves some funds and parks it for the available investment for the future use. This is termed as retained earnings (Clifford & Mohan, 2016). Merits

Demerits

|

|

|

Loans from banks |

Most tradition and best available form of external finance. It bear a fixed rate of interest Merits

Demerits

|

|

|

|

|

|

Public deposits |

Companies with high repute can raise funds from the general public which fulfils both of its short and long term requirements. Rate of interest in generally higher then rate of bank loans |

|

|

|

|

|

|

|

|

The board of directors can use these short term source of finance for financing working capital needs of an enterprise |

Creditors |

Credit given by the supplier of goods and services which reduces the working capital requirements of the business. It is major source of short term fund attainment. Availing of trade credit depends upon the nature of business and credibility of an enterprise Merits

Demerits

|

|

Commercial papers |

It is unsecured promissory notes issued by one organisation to another Merits

Demerits

|

|

|

Factoring |

Using outsider service to clear business debts Merits

Demerits

|

|

|

|

|

|

|

|

|

|

|

On the basis of generation source |

|

|

|

Equity shares |

|

|

|

Retained earnings |

|

|

|

|

|

|

Bank loans |

|

|

Preference shares |

|

|

|

debentures |

|

|

|

Commercial papers |

|

|

|

Factoring |

|

|

|

|

|

|

|

On the basis of ownership |

|

|

|

|

|

|

|

Equity and retained earnings |

|

|

Debentures, bank loans, commercial papers etc |

|

(Wilsker & Young, 2010)

Scenario part b. & d.)

Right issue of shares

The existing shareholders of the company have the preferential rights to buy the shares at the reduced price and at the primary stage before issuing any shares to the general public and outsiders. It is first and foremost right of the shareholder to get the shares purchased from the company. When the shareholder denies to buy the shares then company offers to general public (Wilsker & Young, 2010).

The shareholder can also sell or transfer the right to any other person for any consideration. It is up to the option of shareholder to take following decisions

- Either opt for the right shares either partly of fully

- Transfer or sell the rights for some considerations

- Leave the right and ignore it

Loans stock

These are stocks bearing fixed interest rate. In the UK companies law a shareholder is permissible to invest up to a maximum limit of £ 100,000. To invest more an individual has to invest through loan stocks which bear a fixed rate of interest and can be convertible into equity shares

|

No. |

Basis |

Right shares |

Loan stocks |

|

1 |

Meaning |

Issue of shares to the existing shareholders at a discounted price. It is just like issue of normal share but this time existing share holder are first asked for the purchase of the shares so that their rights remain intact regarding voting rights in the company |

These are general form of loans which can be convertible into shares as a collateral security |

|

2 |

Limit |

A individual cannot invest more than £ 100,000 in equity shares of the company, to invest further one has to opt for the loan stocks |

There is no such limit of investing into loan stock. |

|

3 |

Form of return |

Shareholders get return in form of dividends |

Stock holders get returns in form of interest |

|

4 |

Conversion |

Right shares or any other shares cannot be converted into loan stocks |

Loan stocks can be converted into equity shares |

|

5 |

Repayment in the event of winding up |

Shares holders are repaid after the payment made to the loan stock |

The holders of the loan stock are paid earlier than any equity or preference share holders |

(Wilsker & Young, 2010)

Scenario part c.)

Right issue and loans stock as a source of finance to buildings and noncurrent assets

Issuing shares in both the options but in first case there is direct issue and in second shares are given as collateral to the loan liability. If the company is suitable to interest risk exposure and do not want to expose the controlling rights with lower cost of attaining funds then company should go for loan stocks else issue of shares through right issue would be more preferential way of approach as in the case of choosing fund for long term by way of issuing right equity shares it gives credit worthiness to the company for future loan requirement and it will not create any charge on asset of the company the asset of the company can be further utilised for future mortgage (Rhodes, 2013).

Advice to the board of directors for source of working capital finance is discussed in the above table

Task 2 (Scenario part b)

Scenario part a.)

The board of directors is considering an option to raise funds £ 5,000,000. The company has three alternative course of action. The company can has to choose the best option which is cost effective to the organisation. These alternatives are

- Raise funds by issuing shares

- Issuing loan stock

- Diversify between loan stock and issue of shares (Shkrobot, 2011).

Cost of equity is return on investment or return on equity shareholder. Generally cost of equity is higher than cost of debt. There are two models to calculate cost of equity

- Dividend growth model – it is applicable to those companies which are paying dividend. It is based on future dividends paid by the company

- Capital asset pricing model (CAPM)

Formulae is = (dividend/market price per share) + Growth rate

Cost of debt= return on debenture after paying interest on it, the company when borrow funds from the external source it has to pay interest on it. This interest is cost of borrowing that debt fund. Various sources of acquiring debt funds are debentures, loan stocks, bank loan, public deposits etc. (Shkrobot, 2011)

Formulae = Interest (1-tax rate)/100

WACC - Weighted average rate of return

It is overall return on investment

Formulae of WACC = Cost of equity* weightage of equity investment+ cost of debt* weightage of debt +cost of preference share * weightage of preference share

Note- Equity shares includes retained earnings also

|

options |

fund requirement |

|

|

source of funds |

||

|

|

|

|

|

|

||

|

option 1 |

6000000 |

equity shares |

||||

|

|

|

|

|

|

||

|

option 2 |

6000000 |

5% loan stocks |

||||

|

|

|

|

|

|

||

|

option 3 |

3000000 |

equity shares |

||||

|

|

3000000 |

5 % loan stocks |

||||

(Shkrobot, 2011)

|

|

|

|

|

alternative 1 |

alternative 2 |

alternative 3 |

|||

|

|

ratio or average |

complete equity |

equity and additional |

additional equity and |

|||||

|

|

|

|

|

|

|

debt |

|

additional debt |

|

|

current equity |

5,000,000 |

|

|

|

|

|

|

|

|

|

increased equity |

6,000,000 |

|

|

|

|

|

|

|

|

|

|

11,000,000 |

1 |

14.00% |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

total loan |

6,000,000 |

0.55 |

|

|

1.909091 |

|

|

|

|

|

equity |

5,000,000 |

0.45 |

|

|

6.363636 |

|

|

|

|

|

|

11,000,000 |

|

|

|

8.272727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

equity |

8,000,000 |

0.73 |

|

|

10.18182 |

|

|||

|

loan |

3,000,000 |

0.27 |

|

|

0.954545 |

|

|||

|

|

11,000,000 |

|

|

11.13636 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

(Segrest, 2013)

Evaluation of finance strategy

There are three alternatives available to us

- First alternative focus on attaining fund through equity or owners fund only. As equity is the costliest source of attaining funds, here in our above comparison we found that cost of fund through equity source is 14% which is highest among the three alternatives. But it is risk free cost of capital and assets of the firm are not securitised.

- Second alternative focus higher on debt funds then equity on lower side. This is a mix portfolio of both equity and debt fund with weighted average overall cost of capital of 8.27 % this is cheapest form of attaining funds and controls of the business is not diluted. But there always exists a risk of paying interest in case of debt funds (Segrest, 2013)

- Third alternative is again a mix portfolio of equity and debt funds but this time equity taking bigger proportion in the total chart of long term funds. The weighted average cost of capital is 11.13. This is an average situation considering both the alternative in case of risk and control parameters (Segrest, 2013).

Scenario part b.)

EPS- earnings per share available to the equity share holders of the company. It is increase in the gross wealth of the shareholders of the company. Out of this some part is kept as retained earnings and rest is allocated to the shareholder in form of dividend

PBIT of the said proposal is £ 840,000. To calculate the EPS following formulae is to be utilised(Lucas, 2010).

EPS= profit after interest and tax and preference share dividend / number of equity shares

|

PBIT |

840,000 |

|

(-)interest |

0 |

|

PBT |

840,000 |

|

(-) Taxes (30%) |

252,000 |

|

PAT |

588,000 |

|

|

|

(Lucas, 2010)

EPS = 588,000/5,000,000 = 0.1176

Earnings per share of the Telco is 0.1176 per share

Assumption

It has been assumed that Telco has not opted for the assumptions given in the question. All the above calculations is made before selecting any alternative course of action (Lucas, 2010).

Task 3 (Scenario part c)

a.), b.), c.), d.) & e.)

Investment appraisal techniques

The term investment appraisal helps in making decision regarding proposed long term capital decision.

It is an important process followed by the organisation to effectively and efficiently utilise the resources in the long term investments, the benefits of whose will be derived over a long span of time. The investment appraisal decision helps in gathering long term fund investment decision in anticipation of expected future cash flows. It helps in putting an impact on basic character of the enterprises (Zhu, 2013).

Before accepting or declining the particular proposal the profit consideration should taken into mind. For evaluating the investment appraisal technique any method can be used as basis of which the difference between acceptable and non acceptable techniques of appraisal. While selecting order of priority importance should be given to profitability of enterprise by taking in consideration future profitability also (Zhu, 2013).

There are various techniques and tools which are used for evaluation of investment appraisal. Some of the main techniques are illustrated below

- Payback period technique

- Average rate of return (ARR) technique

- Net present value (NPV) technique

- Profitability index technique(PI approach)

- Internal rate of return technique (IRR approach)

- Modified internal rate of return

- Discounted payback period

- Net present value index(Siano, et. al., 2010)

Payback period is the period in which we can recover our initial cash outflow.

It is the most famous and widely used technique or traditional way of approach for evaluating capital investment proposal. It is number of year taken by the organisation to recover its original investments from net cash flows. It is a very easy approach, quite simple and with easiness in computing value (Siano, et. al., 2010).

For example A company invest in a machine £ 1000000.00 and its annual cash flow is £ 200000.00 so recovery payback year will be 1000000/200000=5 years

It is time require to recover the initial investment without taking time value of money into consideration. It calculated by number of years in which it will require to recover the cash invested. Unlike other method used in capital budgeting technique it ignores opportunity cost

NPV stands for net present value. NPV means to calculate the present value of future cash. It is important tool of capital budgeting which helps us the profitability of viability of the investment to be made in the prospective project. A positive NPV reflects that there exits benefit in making investment in the project where as a negative NPV reflects future loss and project should be dropped. To find NPV we have to consider time value of money, this is to calculate discount rate element and checked whether the future returns are sufficient to meet out the cost associated with the investment made in prospective project (Siano, et. al., 2010).

NPV formulae = present value of cash inflow - present value of cash outflow

Cash outflow means the cash which is infused by organisation in kind of assets or investment.

Cash inflow means the cash which is earn by us through such investment and asset annually throughout the life of the investment or outflow made

In the problem given in scenario chief executive officer of the Telco has a option to invest either by takeover of Talk mobile in Indonesia or Vocal Phone in Brunei (Siano, et. al., 2010).

Option 1 is to invest by takeover of talk mobile in Indonesia

Initial investment - £ 27,500,000

Returns on investment

Company will plough back its funds invested without keeping the time value in consideration is 2.45 years that is payback period of the current investment (Siano, et. al., 2010).

Further there is net present value of £ 4,275,000 is given in question which represent present value of cash inflow – present value of cash outflow. This is calculated by keeping discounting factors and time value of money in consideration. Accounting rate of return given in the problem is 56%

Option 2 is to invest by takeover of Vocal Phone in Brunei

Initial investment - £ 20,000,000 (present value of cash outflow)

Scrap value realised at the end of 4th year = £ 2,000,000

Depreciation = £ 4,500,000

Net profit = 10% of the revenue generated

Cost of the capital of the company = 8%

(Siano, et. al., 2010)

|

|

year 1 |

year 2 |

year 3 |

year 4 |

total |

|

Revenue |

45,000,000 |

54,000,000 |

67,500,000 |

77,625,000 |

|

|

Net profit(revenue*10%)(a) |

4500000 |

5400000 |

6750000 |

7762500 |

|

|

Depreciation (b) |

4,500,000 |

4,500,000 |

4,500,000 |

4,500,000 |

|

|

Residual value(c) |

|

|

|

2,000,000 |

|

|

Net profit before depreciation D=(a+b+c) |

9,000,000 |

9,900,000 |

11,250,000 |

14,262,500 |

|

|

Discount rate(e) |

0.926 |

0.857 |

0.794 |

0.735 |

|

|

(d)*(e) |

8334000 |

8484300 |

8932500 |

10482938 |

36233738 |

(Mestry & Govindasamy, 2013)

Net present value = present value of cash outflow- present value of cash inflow

NPV= £ 36,233,738 - 20,000,000 = 16,233,738

Payback period =

|

|

payback period |

|

|

|

|

|

|

a |

Initial outflow |

20000000 |

|

b |

sum of two years PV of cash flow |

16818300 |

|

c |

a-b |

3181700 |

|

|

|

|

|

|

(3rd year discounted inflow -c/ year 3 discounted inflow) |

0.6438063 |

|

|

|

2 |

|

|

payback period |

2.6438063 |

(Mestry & Govindasamy, 2013)

Comparative analysis between two prospects

|

|

Option 1 |

Option 2 |

|

NPV |

4,275,000 |

16,233,738 |

|

Payback period |

2.45 years |

2.64 years |

|

|

|

|

(Mestry & Govindasamy, 2013)

On comparing the two alternative course of action whether to invest in proposal 1 or to go for proposal 2 we have analysed the following course of action. The NPV in option 1 is higher than in option 2, further if we check towards time period of return of investment that is our basic payback period then option 1 is beneficial with a very small consideration of time. There is not much difference in payback period of both the investments (Weaver, 2014).

f.)

Concept of cost unit

The cost incurred by the organisation for manufacturing or for providing service for one unit of the product manufactured or service provided. It includes all cost whether it is fixed or variable cost of providing service or manufacturing goods. It is measured some time in batches, tones depending upon the nature and type of the product and services (Weaver, 2014). The following are the examples in which unit cost are measured: -

|

Industry, product or services |

Cost per unit measurement |

|

Automobile |

Per number of vehicle |

|

Bricks |

Per 1000 bricks |

|

coal |

Per tonne |

|

Hotel |

Per patient day |

|

Steel |

Per tonne |

|

Chemical |

Per litre |

|

Biscuit |

Per kg |

(Roggi, 2013)

g.)

The factors to be taken into account while setting out prices of outputs manufactured by Telco.

To set up the prices of the Telco organisation it is important to discuss about its long term and short term objectives. For example companies with the aim of profit maximisation only generally tends to set high prices where as companies with objective of market penetration and to cope up with high competition focusing on increase on sales only prefer low prices of their product and services. Price is the value that the buyer gives to the seller for receiving product and services. It is crucial element for any organisation existence as customer is price sensitive. A small variance in the price can shift the customers to the competitors. The price should always match the utility derived from the product and services (Hay, 2010).

The factors taken into account while setting up the price of Telco for their outputs manufactured by them are as follows:-

Cost of product manufactured – The sale price of the product must always cover the total cost of the product and services provided to the customer. Total cost must include both fixed and variable cost of the product and services. The sales price is generally set after setting or framing out total cost. However in some cases in the competition scenario sales price is set by market so we approach for target costing approach, in this we reduce the desirable margin from the sales price to find target cost and try to deliver product or service at that cost. However in some case fixed cost can be ignored for some time but the sale price must cover up variable part of cost at least (Hay, 2010).

- Market competition - when the competition in the market is more than price is fixed keeping in mind the price of rival’s product. For example - coke cannot change the price of its cold drinks in upward trend without considering the change in price of Pepsi.

- Demand and utility of customer- This is further categorised into two segments of elasticity of demand i.e. when the demands of the products or services is not going to change with increase or decrease in prices then demand is tends to be inelastic. Generally company can fix higher prices in this scenario whereas in the case where customers has option to buy at cheaper prices then customer is price sensitive, there available substitutes in the market and demand is therefore elastic . Company has to lower down its prices to sustain in the market (Nilakant & Buckingham, 2016).

- Government and legal regulations- This applies to basic utility products and services which are part of basic needs of an individual. These include medicines, foods and grains, cooking gas lines, education etc. To protect the interest of general public the government has all rights to control prices of its product and services. The government puts a regular check so that there do not exist any unfair practise and further check on monopolistic approach by charging high prices using unfair trade practices like hoarding of basic necessities items, black marketing etc (Nilakant & Buckingham, 2016).

- Introduction of new product -

- If there is new product introduced in the market with high degree of innovativeness then company should charge high prices as market is unknown to the product and to cover high initial research and development & advertisement cost generally products and services are charged with high prices. Later on with the entrants on competitors prices are gradually reduced to stabilise in the market (Nilakant & Buckingham, 2016).

Contact us

Get assignment help from full time dedicated experts of Locus assignments.

Call us: +44 – 7497 786 317Email: support@locusassignments.com

Task 4 (Scenario part d)

a.)

Main trends and messages contained within the cash flow position of the organisation

It is important for the entire organisation to give a copy of cash or liquid management statement with a copy of its final statements. An organisation gives its liquidity statement in aspects of liquidity from operating investing and financing activities. The information gathered through these statements is used to make an evaluation between the above mentioned activities. A single liquid transaction can be classified among the statement differently. For instance the amount of cash flows arising from core operation activities becomes an important aspect in determining the operation capability of the enterprise to repay its cash requirements for salaries & wages, paying loans, buying raw material and other essentials to the basic needs and requirement of the business. This helps in making an analysis that how working capital need of the business is generated and the organisation can manage those needs and requirements. It is required in both profit and non profit organisation. The managing the cash flow is the responsibility of management as both over liquidity and under liquidity in working capital will make trivial for the smooth flow of enterprise. The management has to ensure that a business organisation can easily maintain its operational activities by effective management of working capital cycle (Deegan, 2016).

It helps in increasing earnings to be made from investments by maintaining proper liquid position of the firm further decreasing the debt requirement of firm which in turn will reduce the interest cost of the organisation that will have positive impact on organisational profitability (Deegan, 2016).

b.)

The problems of liquidity management

The cash plays a crucial role in making business decision. Cash or liquidity is required to make day to day payments for example paying of salaries & wages, buying raw material, paying of rent etc. liquity acts as blood for an enterprise which helps him in smooth running of operational activities. It is very important for a business enterprise to maintain sufficient balance of liquity to meet its operational needs. It is seen business enterprise runs in huge profits but there has been difficulty in paying for operational needs due to shortage of liquidity. It becomes some time very difficult to pay even salaries, wages, dividends and taxes (Trotman, et. al., 2012). There has been following reason of shortage of liquidity in spite of huge profits in the enterprise-

- Liquids cash has not been received or transferred in bank accounts by the debtors of the firm

- Sometime even payment has also been received in bank accounts but in some cases it requires hard cash to be paid like payment of wages. These position occur during bank holidays (Trotman, et. al., 2012).

The moment of liquidity is vital importance to any business enterprise. For this there has to be adequate financial planning. It means deciding in advance how much to spend, on what to spend after checking the available liquid fund availability. The fund managers has to make proper forecast i.e. if in near future there will be higher increase in sales then there will be higher requirement of working capital. After deciding the fund requirements the next step of liquidity management planning is to check the short term source of raising finance. This can be both internal and external source of generation. In broader sense it is a short term planning through which sufficient liquidity requirements to be met to meet the obligations in the near future keeping in mind changes in financial position of business due to inflow and outflow of cash for short range business purposes. Liquidity planning is the important tool of the management which further helps an organisation in meeting following objectives- - It helps in making efficient cash management of the business enterprise- evaluation of financial policies and cash position of the business

- It provides information about funds which will be available for managing business operations which further helps in making internal financial management as liquidity is the main basis for all the operations which will further help the management in planning and coordinating the core activities of the business organisation.

- It makes the complete chain of liquidity movement the increase or decrease in the liquid cash can be measured through a statement. It further describes the reason of low liquidity in the business in spite of heavy profits or in the cases where there is huge cash liquidity available in the business in spite there are losses or low profits in the business (Horngren, 2013).

- The level of success or failure of liquidity management planning by making a comparison analysis between the projected statement of liquidity analysis and actual statement. So that if there will be deviation then proper remedial actions can be taken into force.

- The statement prepared which helps in making liquidity analysis helps in making estimate of nearby liquidity requirement and supply of liquidity in coming future (Horngren, 2013).

c.)

Users of financial statements

Investors – the shareholders who tend to invest in the business of the Telco makes comparative analysis on the basis of their risk appetite. To gain information on all the aspect one need the financial statement of the organisation. Through this investor can come to know about the earning capacity, profitability and future prospects. Through financial statements one can easily access all these data.

Management

The management which include board of directors, chairman and other bodies can get lot of information through financial statements that how much funds are required for future projects how they can better explore through the available opportunities in the market. How business can control unnecessary expenditures and better monitoring of enterprises resources. This is all possible through financial statements (Weetman, 2013).

Banks

Banks needs audited balance sheet and other financial statements for sanctioning of loans. Other lenders of funds like debenture holders, stock loans are also interested in financial statements to know the viability of the business.

Customers

Customers need to know the going concern of business. In case of insecurity in dealing with business due to its weak financials they move on to other suppliers (Weetman, 2013).

Stock exchanges

It is an apex body which helps in dealing with shares and debentures and regulates if there exists any unfair trade practises like insider trading. To cope up this situation stock exchange needs financials of the company at regular intervals.

Government

For taxation and putting other controls over and above the business enterprise the government through financial statements can exercise the same. For laying all kind of taxes and checking the legality and nature of business checking of financial statements acts as a important tool (Weetman, 2013).

Society

Financial statements tell us about the earning capacity of the business enterprise. If the company is charging too much margin over the cost it will be reflected in the profitability of the business. The society can put a control on such business to check customer exploitation (Weetman, 2013).

Task 5 (Scenario part e)

a.)

Financial ratios to analyse the profitability and liquidity performance of year 2014/2015 of TESCO

|

|

Ratios |

2014 |

2015 |

|

1 |

Current ratio = current assets / current liabilities |

The current assets of the year 2014 for DOT plc is = 200/178= 1.12 |

The current assets of the year 2015 for DOT plc is = 130/140= 0.928 The current liability coverage has been reduced there is less current assets over current liability in percentage terms |

|

3 |

Net profit Ratio = Net profit/ Net sales *100 |

The Net profit Ratio of the year 2014 for DOT plc is = 654/2200*100= 29.73% |

The Net profit Ratio of the year 2015 for DOT plc is = 458/1800*100= 25.44% There has been decrease in the net profit for the year 2015 as comparison to previous year |

|

4 |

Gross profit Ratio =Gross profit/ Net sales *100 |

The Gross profit Ratio of the year 2014 for DOT plc is = 1000/2200*100= 45.45% |

The Gross profit Ratio of the year 2014 for DOT plc is = 650/1800*100= 36.11% There has been decrease in the gross profit for the year 2015 as comparison to previous year |

|

5 |

Debt equity ratio = long term debts / shareholders funds |

The Debt equity ratio of the year 2014 for DOT plc is = 750/2795=0.27 : 1 |

The Debt equity ratio of the year 2015 for DOT plc is = 0.23 : 1 The Debt equity ratio coverage has been reduced there is less equity or owner’s fund cover over Debt funds |

(Kemp & Waybright, 2013)

b.)

Differences between financial statements of sole traders, partnership firms and limited companies

|

|

Sole traders |

Partnership firms |

Limited companies |

|

Capital fund |

There is only one single capital account which discloses the amount of fund invested by the proprietor in his business deducted by drawings and added by net profit |

It shows the capital accounts of the partners in the business added by net profit, interest on capital of partners, salaries to partners deducted by drawings , net loss , drawings and interest on drawings |

It shows shareholders funds which is comprised of share capital retained earnings other revenue and capital reserves |

|

Taxation |

Tax will be charged on the net income earned by the proprietor of the firm |

Tax will be charged on the total earning of the partnership firm as a separate unit |

Tax will be charged on the income of the company as a separate unit |

|

Audit compliance |

Generally not subjected to audit |

Subject to audit in case of high turnover given in respective state laws |

Subject to audit even in case of losses fulfilling all audit compliance procedures, rules and other audits framework |

|

Accounting standard |

Generally not subjected to follow accounting standards as per generally accepted accounting principles |

subjected to follow accounting standards as per generally accepted accounting principles where firm is subject to audit |

subjected to follow accounting standards as per generally accepted accounting principles rules and other accounting frameworks |

(Freeman & Freeman, 2010)

Conclusion

In the end it is concluded that there are various sources are available in the form of bank loan, right issues of shares, leasing and many more. Management is highly focused over making effective use of working capital in order to process the business activities in effective manner. Management make use of investment appraisal techniques in order to analyse the profitability of the project or investment proposal. These techniques include NPV, PBP and others for evaluating their profitability. Financial ratios are utilised in order to make the financial analysis of the organisation.

References

Clifford, D. & Mohan, J. 2016, "The Sources of Income of English and Welsh Charities: An Organisation-Level Perspective", Voluntas, vol. 27, no. 1, pp. 487.

Deegan, C.M. 2016, Financial accounting, 8th edn, McGraw-Hill Education (Australia) Pty Ltd, North Ryde, N.S.W.

Hay, J. 2010, "Too Good to Fail: Managing Financial Crisis Through the Moral Economy of Realty TV", Journal of Communication Inquiry, vol. 34, no. 4, pp. 382-402.

Details

Other Assignments

Related Solution

Other Solution