- support@locusassignments.com

Unit 2 Finance in the Hospitality Industry Assignment Solution Copy

Introduction

Various aspects of accounting and costing have been explained through the exercises below. This assignment throws light on the importance of budgeting and other various important things like notes to accounts.

Task 1

1.1 Sources of finance available to a business

Capital is required for the starting up of business. Capital is not only required for starting up but also for the expansion of existing business. The sources of finance available to the business are as follows:

Debt Funds: The organization can opt for debt funds. The interest paid on such funds is an allowable tax expense. This implies that the interest paid on such funds would be tax deductible. However this would not be applicable for the government as the government is not required to pay taxes. (Bhowmik and Saha, 2013, pp. 61--71)

Taxes Collected: The best source of finance for the government would be to make use of tax payer’s money. This is the money that has been collected as taxes from the citizens of the country. The government is not required to pay anything on this money as this is the property of the state.

Shares/Equity: The government can incorporate a company for this project and raise capital by issuing stocks and shares. Stocks and shares are only repaid at the time of winding up of the organization. The organization issuing the shares has to pay dividends on such shares. Generally such dividends are paid on the face value of the shares. Generally the cost of equity is the highest as these are paid the last.

From the above discussion it can be concluded that the government can make use of the tax payer’s money to fund the project under consideration.

1.2 Possible ways of generating income from the theme park

Memorandum Report:

Theme parks have a huge operating cost and require a lot of money to keep them running. In the recessionary phase of 2006-2010 almost all the theme parks across the world felt the pinch. There are generally various avenues of generating revenue in theme parks. There are water parks, joy rides, refreshment joints and picnic grounds.

Sources of Revenue:

The various such sources have been described below:

Joy Rides: This is the biggest source of revenue for theme parks. Almost 80% of the revenue of the theme parks is generated by this source. However there is a huge cost associated with such rides. All the rides have to be made by world class engineers and have to be tested in a real time environment. These joy rides also have a huge operating cost associated with them.

Water Parks: These are also one of the most important sources of attraction. According to a report by IBISWorld the average consumer spending on theme parks is expected to increase by 1.3% in the next five years from 2013. This really is a positive signal and the organization should capitalize on the same.

Picnic grounds: The Company can have some vacant land dedicated to building picnic spots. These spots attract old people who cannot enter into a joy ride or a water ride. The income of food joints is also related to such picnic spots.

Refreshment Joints: Refreshment joints also generate revenue for the theme parks. This idea can be implemented in two layers. The company can own its own food joints which would a direct source of revenue and can also rent places to world class restaurants for example the company can invite Dominos, Pizza Hut etc. The advantage of having world class food joints is that the company can use their popularity to generate revenue. (Bardswich and Flannery, 2006)

Task 2

2.1 Identify examples of direct costs, indirect costs, fixed costs and variable costs incurred by Hotel Icon and Upper House.

The various types of cost incurred by the hotel are as follows:

Direct Cost: Salaries, linens, crockery, food and drinks, retail expenses, occupancy cost.

Indirect Cost: Room cleaning supplies, fire insurance, supplies used in spa and gym.

Fixed Costs: Salaries paid to employees, Salaries to bus drivers and attendants, Maintenance cost, Salaries to restaurant staff, cost of operating spas.

Variable Costs: Food, Drinks, Cost of Operating Busses (Fuel)

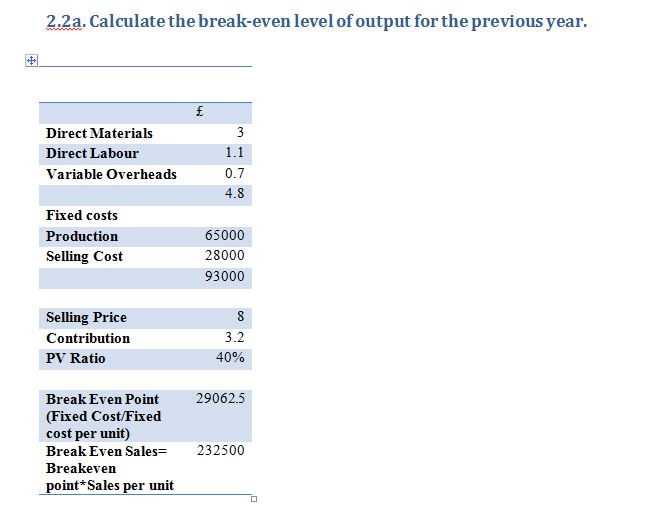

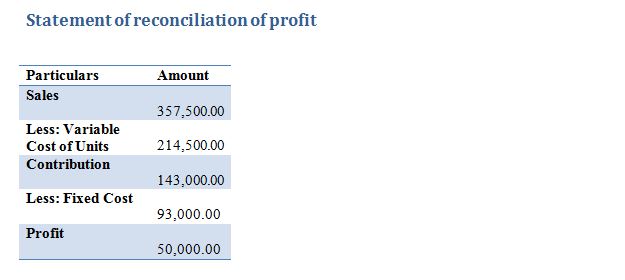

2.2 d. Evaluate the limitations of cost-volume-profit analysis

The limitations of using CVP analysis have been given below:

- This process/analysis is used for a single product. Places with joint or multiple products face difficulty using this.

- Answers only hypothetical questions

- As this is statistical in nature, the data obtained from such analysis has to be used very carefully. (Yunker and Yunker, 2003, pp. 339--365)

- The method works on various assumptions which are always not correct:

- The selling price and the variable cost remain the same.

- Fixed cost remains unchanged.

- Inventory balance does not fluctuate

- Constant or even production

2.3 Firms in the travel and tourism industry can follow different pricing strategies to achieve profit. Analyse the different pricing strategies that can be followed by Icon and Upper House, taking into account the conditions they are currently operating in.

Pricing

The pricing strategy followed by travel and tourism industry is generally not constant and keeps on changing. The pricing strategy has to keep on changing in order to stimulate the demand. The various pricing strategies followed by these industries are as follows:

Rack rates: These are the full rates and the ones that are generally printed on the brochures. Activity and attraction operators don’t give discounts on such rates and generally charge them at full. However the accommodation providers have to generally consider these rates. During peak seasons these rates are charged in full but discounts have to be provided during the off seasons.

Seasonal Pricing: The pricing is designed in such a way so as to account for the busy, medium and off seasons. These prices never change as they have been designed keeping the entire year into account.

Last Minute Pricing: Last minute prices are generally the discounted prices. These prices are offered at the last minute to stimulate the demand.

Package Deals

Having package deals in place is a good idea and helps to avoid offering discounts. This also helps to stimulate demand as the consumer gets everything in one place. The hotel should try to strike deals with local businesses in order to boost the demand.

The organization should consider the above in setting the pricing strategy. The organization can opt for seasonal pricing as that would enable the organization to account for the full year’s profit. The organization should also try to strike deals with local businesses in order to boost demand.

2.4 Evaluate how the management of the souvenir shop would control their stock and cash flow.

An organization has to keep a track of the stock as that can affect the profitability of the business. The carrying cost and the ordering cost has to be taken into account. In order to keep a tab on the cash flow and inventory the organization will have to assess the following:

- Economic Order Quantity: The organization has to keep a tab of the EOQ. EOQ is the quantity where the cost is the lowest. This comprises of the ordering and the carrying cost. For this the organization has to estimate the annual demand of the product and order accordingly.

- ABC Analysis: There are a lot of products which have to be purchased by the document. Generally 20% of the inventory makes up 80% of the cost and vice-versa. The company has to first understand the trend. It needs to focus more on the 20% and balance its purchases accordingly. Such 20% should be purchased at the last moment.

- Ratios: The business needs to have a clear understanding of the ratios. For example how many times has the stock been cleared and restocked. The business needs to have a clear understanding of this. The other important ratios are sales to stock ratio, sales per square feet etc. (Bragg, 2011)

Apart from the suggestion made above the organization can also have a Just in Time purchasing system and can have good retail software. This would allow the organization to save on the carrying and other related costs and keep the cash flow intact.

Task 3

3.1 The restaurant at Icon has requested a supplier to quote the price for the supply of caviar. The supplier has prepared the following standard cost information for a batch of caviar.

Calculate the direct material price and usage variance

Calculate the direct labour rate and efficiency variance

Explain the possible reasons why these variances may have occurred

The variances have occurred due to the following reasons:

- Material: The material usage was assumed to be 24000 units whereas the material used was 26400. The biggest reason for the same might be lost in production. The material conversion rate had not been properly estimated. The other cause of the variance is the difference in the rate of 0.25. (Drury, 1992)

- Labour: Labour was assumed to work for 39600 hours but worked actually for 40200. Machinery breakdown and repairs can be one of the reasons. The other reason might be high turnover ratio. New workers would complete the same task in more time as compared to the old ones. The rate assumed was lower than the actual rate by 0.20.

3.2 You have been recently appointed as a financial consultant at the Icon restaurant to assist non-finance managers. At a staff meeting you have been asked to explain the following;

(a) The source and structure of the trial balance

The trial balance has two sides. The first is the debit and the other is the credit side. All the debit figures are shown on the debit side and all the credit figures are shown on the credit side. The trial balance should match at all times. This means that the total of the debit side should be equal to the total on the credit side. The trial balance checks the accuracy of double entry system. Every entry should have a debit and a credit aspect. Trial balance helps to check if that principle is met and the entries have been posted correctly. However where the debit and the credits have been posted to the wrong accounts the trial balance cannot detect such errors.

(b) Discuss the budgetary control process and how this process helps management decision making at Icon Hotel.

Budgets are very elements of the planning process. Budgets help the organization to estimate the various avenues of expenditure. Budgets help the organization to plan in advance. A typical budgetary control system would include the following:

- Preparation of various budgets: The organization can prepare a range of budgets to keep a tab on the various activities. The organization can prepare a cash budget, production budget, operating budget etc.

- Comparison: The budgets are to be compared with the actual results. The comparison will allow the organization to locate the areas of difference.

- Revision of Budgets: The budgets have to be revised in the light of changes in the circumstances. (Allen, 1997)

A good budgetary system would enable the organization to control costs and manage more efficiently. The organization under question should install a proper budgetary system and compare the budgets with the actual every month. This way the organization can understand where the expenditures are being exactly. Based on the importance of the expenditure the organization can control or stop it. It can also allow the company to understand the avenues of adverse difference.

(c) The usefulness of the business accounts and the significance of the notes to the accounts that may often be used in their annual accounting statements.

Notes to accounts are an integral part of the books of accounts. The various accounting policies followed by the organization can be understood from the notes to accounts. If the organization has not followed any accounting standard the way it is supposed to be followed, it will report such deviation through the notes to accounts. Notes to accounts help in comparability. The notes to accounts also help in understanding any adjustments made to the account. A clear cut understanding of the books of accounts is not possible without the notes to accounts.

Task 4

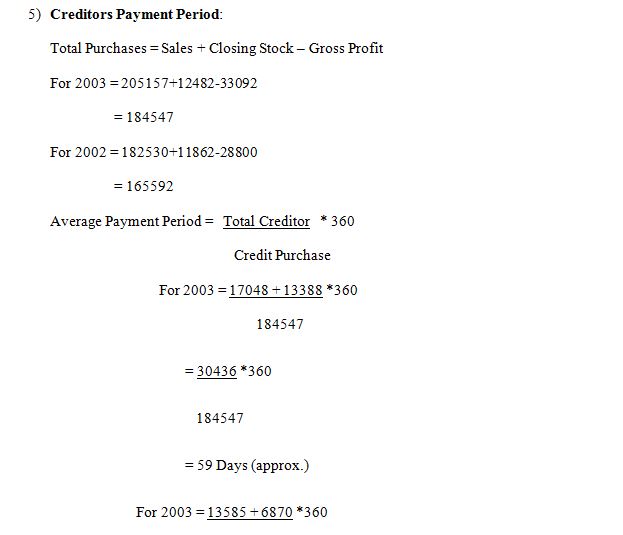

4.1 Calculate the following ratios and analyse the performance of the hotel for the last two years

= 44 Days (approx.)

4.2 Suggest future management actions and strategies based on your analysis above

The gross profit margin has improved as compared to 2002. There is an improvement of 0.35% from the year 2002. The return on capital has reduced as compared to the year 2002. The ROCE has taken a hit of 7.11%. This has primarily happened because of increase in the expenses and interest payable. (Hansen & Palmer, 1997)

Other expenses and interest payable have increase disproportionately as compared to the increase in sales. The organization has issued fresh shares but the money received from such shares has been used to finance the assets of the organization. Though the liquidity ratio is sound but the liquidity position has reduced as compared to the year 2002. As far as the debtor’s payment period and creditor’s payment period is concerned the firm is just about ok. However the creditors unpaid for more than a year have increased. The top management should look into the reasons. If possible the top management should inquire into the reasons for the increase in the expense and interest payable ratio.

Conclus?ion

The exercises solved above help us in understanding the importance of notes to accounts and various other costing techniques. The application of the above mentioned costing techniques help the organization in keeping a track of the inventory level and price the product correctly.

References

Allen, D. 1997. Dynamic Budgetary Control. London: Thorogood.

Bardswich, M. and Flannery, J. 2006. Amusement parks. [Oakville, Ont.]: Rubicon Pub.

Bhowmik, S. K. and Saha, D. 2013. Sources of Finance. Springer, pp. 61--71.

Bragg, S. M. 2011. Inventory best practices. Hoboken, N.J.: Wiley.

Drury, C. 1992. Standard costing. London: Published in association with the Chartered Institute of Management Accountants [by] Academic Press.

Details

Other Assignments

Related Solution

Other Solution