- support@locusassignments.com

Unit 2 Managing Financial Resources and Decisions Solution

|

Program |

Diploma in Health and Social Care |

|

Unit Number and Title |

Unit 2 Managing Financial Resources and Decisions |

|

QFC Level |

Level 4 |

Introduction

The success of the business largely depends upon how effectively the manager utilize various resources to run business operation. The management needs to make decision how it uses its financial resources and monitor its budget to manage business operation. The management needs to effectively manage its finance to attain the goals and objective of the business. The management used various type of budget to check that the financial resources of the company are properly utilized and there is no wastage of resources.

Task 1

1.1 A clear outline explanation of the principle of costing and business control system.

The costing helps the management to effectively manage its financial resources to conduct business operation effectively. The costing helps in computing cost of production and running business, by allocating various expenditure to different areas of the business operation. The costing is the technique used by the management to compute the total cost per unit by considering various fixed and variable cost used in producing goods and service. This also helps in decision making in relation to the various area of the business and effectively handle all the cost which are required to run business. Through costing the management can easily determine the cost which is incurred in producing the product and service and helps in determining the price of its product and services (Innocent & Chimezie, 2013).

To effectively manage the business the management needs to effectively manage all the cost which is incurred to produce the good. The costing helps in proper allocation of various cost on the different unit or function of the business. The key principle of costing are as follows.

The management needs to check that the cost which is incurred while conducting the operations are properly allocated to the unit or product to make effective decision in relation to the business. The management needs to collect the various cost as per the nature and allocate and apportion those cost on the basis of cost relationship.

The management needs to check that the cost is charged only after they are incurred. The management needs to check that the cost is charged to the unit where it has occurred and ensure that the cost is not imposed on the other unit.

The costing ensures that the cost which is incurred in the particular period should be meet by the profit of that particular period only. The cost of the past year are included in the current period than it will provide inappropriate result to the management because it creates inappropriate burden on the particular year (Martinez, Kromann, & Astrup, 2015).

The organization generally keeps the accounts for the cost as per double entry system to effectively manage business operation. The costing uses the various cost sheet and the cost statement for the purpose of ascertaining cost and provides cost control guidelines to the management.

The management also needs to check that the abnormal cost are not charged to the production unit as the cost has no relation with the production part. It will mislead the management in making various pricing or other decision of the business. The costing helps in ensuring that the abnormal cost are charged to cost center and not to any of the production unit. Also the other expenses which doesn’t have any relationship to the operation are not charge to the costing (Reineking, Chamberlain, Rudolph & Smith, 2013).

The various business control system use by the manager in the process are procurement process and business control system.

Procurement process

The procurement process requires the series of steps such as finding, acquiring and purchasing the resources which are required to manufacture goods and service. The procurement process is too dynamic that it requires constant analyze and monitoring all the activity within the organization. The home care can follow the series of the steps to effectively acquire the resources while conducting their activity. To effectively manage the procurement process the manger needs to follow the series of steps which start from need recognition and involves sources, price, expenditure, and invoice and maintain the records.

Management control system

The management control system gathers the information to evaluate the performance of the various unit of the business. It is the tool to measure how effectively the business is conducting its operation to attain the objective and goals of the business. The management control system involves the set of the activity or decision which are taken by the manager to establish purpose, allocate resources and achieve organization purpose. The management control system unites the different parts of the organization so that each unit perform their work effectively which help in fulfilling overall purpose of the organization.

The cost which the care home incurs per month on one resident is as follows –

Fixed cost = 75000

Average variable cost = 1200

Total cost = 76200

No of resident = 65

Cost per month on one resident is as follows = 76200/65 =1172

1.2 Information needed to successfully manage the business operation.

To effectively conduct the operation of the business the manager needs to effectively manage all the cost which hare to be incurred to run the operation of the business. The cost is the amount which the company paid to acquire and use certain resources of the business. The management for making various decision needs to ascertain cost per unit incurred by the company to manufacture its product and service. The cost center is the unit of the business which is not involved in the production activity and adds to the cost of running of the company. The cost which is incurred on the cost center is allocated to the production unit of the business. The cost which the resident home has to bear are as follows-

Direct cost

This is the cost which can be directly attributed to the particular product and service of the company. For example the cost incurred on acquiring resources which is used by the resident home t0 produce food for their member.

Indirect cost

These are the cost which cannot be attributed to the particular unit has to be apportioned between the various unit of the business. For example the house rent paid by the resident home cannot be allocated to the particular unit and has to be apportioned between the various function of the business.

Variable cost

It is the cost which varies with the outcome which the company is producing. For example the wages paid to the kitchen staff varies with the food which they are producing.

Fixed cost

These are the cost which doesn’t varies with the level of the outcome and are charged to the outcome of the business. For example the salaries paid to the manager is fixed cost and the company has to incur it irrespective of their activity.

To improve the profitability of the business and grow its operation the management needs to set both short term as well as long term goals for the business. These goals provides the direction to the company to improve its position in the market. The management needs to set up the goals to control the business and focus on key area of the business. The goal setting helps in effective utilization of their resource and create the positive environment within the organization.

1.3 The explanation of regulatory requirement for managing financial resources.

To effectively manage the resources the management has to follow certain regulation which is set by the regulatory body to check that the organization are making effective use of the financed resources. They provide the guideline to the manager which describes the standard below which there outcome shouldn’t fall. The GAAP also provides certain guidelines which the resident home need to follow while maintaining its accounting records. It ensures the minimum level of the consistency in the financial statement of the company which makes it easier for various stakeholder to understand and useful information about the company. It also provides the clarity of the communication of the financial information and helps in making comparison with the other companies. The care quality commission provides the standard and makes effort that the standards may not fall below standard. The health and social care needs to ensure that the customer are treated with dignity and respect at all time while receiving care and treatment. The organization need to ensure that the appropriate consent should be provided before the treatment and the provide safety during the treatment to customer. The commission also ensures that the customer are not abused or receive improper treatment while receiving care. It also check that the organization effectively handle the complaints of the customer.

1.4 An evaluation of computer software as a mean of managing the financial resources.

The management of the company uses the various software to manage its income, expenses, and the assets with the objective of maximizing profit and ensuring that all the business operation are conducted in the effective way. It improves both short term as well as long term performance of the business by providing the various information to the management. These software helps in collecting huge information in relation to the operation of the business and helps the management in decision making in relation to the various area of the business. It also helps the management to check that the operation of the business is conducted in the planned way. It also helps in building coordination between various areas of the business and minimize the paperwork. These software provide ease in maintain huge data and effective analyze of the data which helps in making informed decision.

The advantage of using these software to manage the financial resources are as follows-

- Provide quick and detail information which helps in decision making.

- The information provided by these software is fast and accurate.

- There are less chances of error while recording information using these software.

- It is easy to store the information through these software and helps in reducing the paperwork.

- It helps in reducing the cost which the organization has to incur to record the transaction.

- Helps the management to monitor and control the operation of the business (Adane, Abiy & Desta, 2015)

The disadvantage of the accounting software while managing the financial resources are as follows-

- The small scale business cannot use these software as the cost of purchasing these software is pretty much high.

- Some software is designed in the way that it is difficult to use them with the existing organization structure of the company.

- There is huge chances of the data loss and the stealing of the data which may affect the functioning of the business.

- The organization need to train its staff to work on these software which may cause extra cost to the company.

- The error in recording the data may result in wrong outcome to the management.

Task 2

2.1 Discuss the various sources of the income that might be for her new care home.

The manger to effectively manage its financial resources need to identify the sources from where it can raise fund for the operation. The management for the purpose of running the residential may generate the income which are as follows-

Gift and donation

This is the major source through which the new home care can raise fund for running its operation. There are many individual, companies or charitable trust foundation which may provide the fund for the new home care business. The benefit of this sources is also that the government doesn’t impose tax on it.

Grants

The new home care may also receive the fund from the grants which are received from the government and charitable and are not to be repaid by the management.

Trading

The organization can also earn by selling the product and service to member, general public or the other organization. These sources can also collect the fund by conducting various event which attract huge fund for the business.

Share capital

The organization has the choice to raise huge amount of the fund through issuing preference and equity share of the company. The share capital is the cheapest source through which company can raise fund. The major drawback of these source of fund is that it reduces the control of the existing shareholder of the company.

Term loan

The organization can also raise the fund for the longer period by availing the loan from the various financial Institutes, government and commercial bank. Many of the organization use the source as it provides easy availability of the huge amount of fund. Theses fund are secured against the assets of the company and are considered as secured creditor in the winding up of the company.

Debenture/bond

The organization can also raise the fund for the longer period through the issue of debenture of the company. The debenture are not secured by the fixed assets of the company and helps in providing security to the capital. These debenture carries the fixed rate of interest and are too redeemed after the particular period (Alinezhad, Vahid & Ebrati, 2012).

2.2 Factors which may affect the availability of the finance.

There are many factors which affect the availability of the finance, the management needs to examine the sources from which it can raise fund on the basis of the cost and availability. The factor which will affect the financing of the new home care are as follows-

Government funding

The fiscal policy of the government has a huge effect on the availability of the fund for the new home care. If the government will provide the exemption to those which are providing the fund for the benefit of the employees that they will attract the huge fund for the business. The government to promote the health and social care provides a huge fund.

Social deprivation index

Social deprivation is the prevention and reduction of culturally normal interaction between the individual and the rest of the society. The deprivation index measure the deprivation in the particular area. If the particular area is not economically developed than it will attract the huge fund from the government to develop the standards of the public of that region. It will provide ease to the new home care in the availability of the fund for running its operation (Zarei, Rad, Ghapanchi & Ghapanchi, 2015).

Priority of the project

There are certain social care area where the government are making huge effort for the development of the standard of the people. If the service provided by the new home care is similar to those project on which the government in making the great emphasize than the organization will attract huge fund from the government.

Private funding

There many of the health and social Care business which are funded by the other institute and individual rather than depending upon the government. Many of the private institute to improve their CSR donate the fund for the welfare of the health and social care sector of the company.

2.3 Review the various kind of budget expenditure in health and social care organization.

Cost center

The cost center is the unit of the business which doesn’t produce direct profit but add to the cost of the running of the business. The cost which is incurred by these center is apportioned between the other production units of the business.The management need to trace all the expenditure to effectively handle the activity of the business. The cost center helps in allocating the expenditure which cannot be allocated to the particular production unit.

|

Cost center |

Profit center |

|

It is the department of the company to which the direct and indirect cost are charged. |

It is the unit of the business which recognize the profit of the business. |

|

Its objective is to control cost and reduce cost |

Ascertain the profit and efforts to maximize it. |

|

Operates in the narrow area |

Operates in the broad area |

|

Easy to operate |

Involves complexity |

Project management

The project management is the tool which the manager use to manage the product by distributing the project under various units. The project management helps the manager to effectively manage the project and receive the desired outcome from the project. The project manager distribute the project into different activity to effectively manage the project (Mehdi & Reza, 2012).

Outsourcing

The health and social care organization can outsource many of its activity to check that they are conducted in the effective way and at the best cost. The new care home can transfer its food production or the maintenance of its premises to get the work done in the effective way. This will help the manager to focus on its key area of the business by outsourcing its major activity to the other business. The outsourcing of the work provides the best quality outcome to the manager and at the lowest cost.

2.4 evaluate how the decision about the expenditure are to be made in the resident care home.

The manager of the resident care home needs to create the budget to effectively manage all the expenditure which will be incurred while running the company operation. The budget helps the management to conduct its operation in the planned way. The management can check that its each of the activity is conducted in the planned way by comparing the actual performance with that which is set in the plan. The decision in relation to the expenditure are made after analyzing the benefit which will arise from the expenditure (Thorn et. al. , 2016).

Task 3

Understanding and monitoring the expenditures through Budgets in health and social care organization

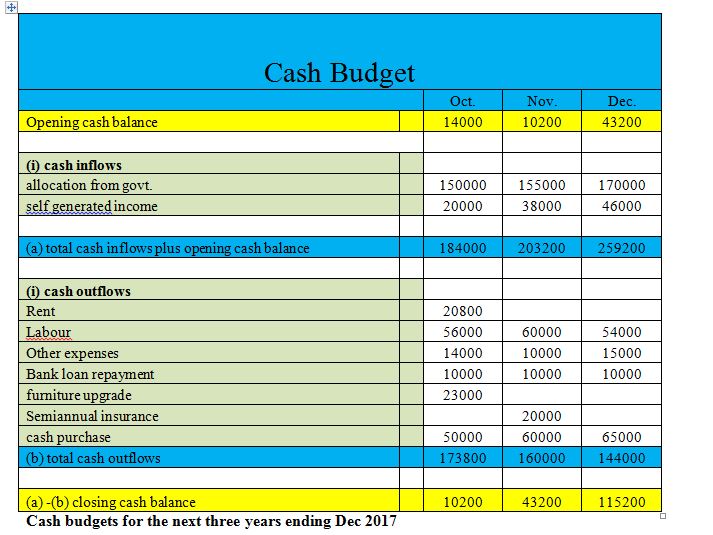

3.1 Explain Cash budgets and how it helps in managing Budget shortfalls?

Cash budgets

It is quantitative expression of future forecasting of cash requirement and disposal of excess cash if any exits in the firm. It represents operational plan of the management for the budget period. It is always expressed in money terms

Cash budget helping in managing budget shortfalls

On comparison of actual performance with the plans it is indicated to do the measures by making periodically comparison of plans. Cash budget is prepared for each of the cash inflow and outflow function in realistic terms. The overall budget is coordinated with each other. It is part of the financial budget that is concerned with cash receipts and disbursements, working capital, capital expenditures financial position and business cash operations. It helps in managing the shortfalls of the business in terms of cash & liquid financial. In case of liquidity crisis or shortfall in cash position this statements helps the firm in managing or arranging the fund requirements from various sources of finance. This can be debt funds, equity & working capital finance. The requirement of finance whether it is for short term or long term horizon depends on analysis of cash budget statement (Haroun, 2015).

Practical examples related to residential care

While considering residential care and hospital units on taking case study of Fortis hospitals & Eternal hospital group it is analysed that without cash any hospital will not survive, liquidity is essential for maintaining its going concern. In these hospitals it is reviewed on monthly basis. For instance to check losses in the hospital business there will be increase in capital expenditure in its budget and further there is increase in losses through working capital additions. To cope up with this situation a residential care institution will look forward for the possibilities of attaining funds through long term and short term sources of borrowing funds as per requirement of firm. Will analysing cash budgets we will also came to know about the excess cash availability in the fund. Further it also describes the fund source availability from various sources like Government grants or whether it is a self-generated income. This helps the government departments to track the statement of cash to know whether the hospital and residential care firms are utilising the grant funds provided by local govt. as per the guidelines and rules & regulations of the grant. It helps in segregating the sources of funds in various categories like debt fund, equity funds etc.

3.2 What can she do if she suspects frauds in the cash budget?

Wherever there is public money invested or there are government grants infused in the business there is huge vulnerability to risk of fraud and error. She should make an organisational environment to follow ethical cash budgeting and avoiding frauds and financial malpractices. There are some areas where she has to work to follow good practise in tackling external and internal frauds and errors. Further a manual should be prepared for internal audit purpose that should be reviewed and checklist should be filled from time to time on those areas where there is more scope of vulnerabilities to the occurrence of threat to get exploited by financial frauds and errors. Following are the steps she can take to conquer financial frauds and errors (Reed et. al. 2012).

- Setting up examples to detect, prevent, reduce and investigate those departments where huge inflow and outflow of cash exists

- Internal audit and management body should be set up with continuous monitoring of various departments of the organisation

- The management is able to take corrective action on the financial errors whenever there is discrepancy in performance.

- By reporting deviations if exists which is reported by various budgetary control tools so that necessary actions can be taken at the earliest. In the absence of a budgetary control system the deviation can be determined only at the end of financial statements

- By setting targets for the employees they are made conscious of their responsibilities further there is less scope of leakage of income by financial frauds and errors as future forecast of income gives an approx idea of the revenue generally generated.

- Efforts will be made at those places where performance is less than stipulated.

3.3 Suggest and evaluate methods used to monitor and control budgets?

There are various methods which are necessary to control budgets and successful implementation of budgetary control system. Some of these are as follows

- A budget control and administrative officer should be appointed by the top management. The budget officer should be given power to scrutinize the various budgets prepared by various departments and if required make the relevant changes in them. He finds the deficiencies in the budget and takes proper actions in rectifying them. He works as a manager for making coordination among various departments. He also makes a performance analysis charts describing the performance of various departments.

- By creating budget centres as a part of basic organisational activities of the period for which budget is prepared. A budget centre may be the departments or any part of respective departments which is necessary for cost control purpose

- Creation of budget manual – this helps the organisation in setting up the guidelines for creating various budgets and setting out authority subordinate relationship of the persons engaged in routine tasks. All the departments of the organisation for getting any procedure or downloading any formats of any particular task for every part of organisational works like from the initial stage of preparing budget to the actual reporting refers budget manual prepared on the initial stage (Wilson & Wolak,2016).

- Preparation of variance analysis statements by taking in reference trends and recommendations for the future projections

- By creating responsibility centres managers or departmental heads are set responsible for various divisions and departments of business. These are revenue, expense, profits and investments centres. Each departmental head is made responsible for the outputs generated in respected departments

- Reviewing the budget statements and finding further scope of improvements

Task 4

4.1 The information needed by the manager to make decision about the level of service which will be provided to the users and the funding organization.

The management uses the costing as a tool to make informed decision in relation to the income and expenditure of the business. The costing provides helps the management to ascertain the cost which will be incurred on running the operation of the business. The management needs to collect the huge data and use various accounting tools to make informed decision in relation to the business.

Management accounting

The management accounting requires the preparation of various reports and account to provide accurate and relevant information to the manager to make various decision in relation to the business. It assist the manager to make both short term as well as long term decision which helps in attaining the objective of the business. It is the process which involves identifying measuring, analyzing and interpretation and communicating to attain the organization goals and objective (Pazarceviren & Dede, 2015).

Current and the projected demand for service

The management to run the business effectively needs to make the estimate of the demand of the service and makes effort to deliver the best services within the allocated resources. The estimate of the demand helps in effectively manage all the service of the business.

Actual budget

The management needs to create the standard budget of the cost and expenditure which are going to be incurred during the year. The management also prepares the actual budget to find the variance from the planned budget and find the cause of the variance. The management also needs to consider the reason for the deviation while preparing the future budget of the business.

There are various regulator in health and social care which provide the guidelines to the organization who are running health and social care business. They also check that the organization is not engaged in any fraud and doesn’t misrepresent any fact while preparing the financial statement of the business.

4.2 Analyze the relationship between the level of service she will offer and the expenditure.

The level of the service which the new home care offers and its cost depends upon the various factor which are as follows-

Transparency with the stakeholder

The management needs to maintain the proper records of how the company is utilizing the fund raiser for running the business. The management should ensure that the organization maintain transparency while recording how the company has utilized its fund (Ozyapici& Tanis, 2016).

Compliance

The management needs to ensure that the organization is following all the regulation while conducting its operation which are required by the legislature.

Accountability

while recording the transaction the management needs to ensure that the double entry system and all the accounting principle are followed.It provides the transparency to the various stakeholder in relation to the financial performance of the business.

Pricing policies

The costing helps the management to ascertain the per unit cost of the product and helps the management in determining the price of the product. This helps the management to make the informed pricing decision.

4.3 evaluate how financial consideration will have an effect on the individual.

The financial consideration is the money or the other things exchanged for the product and service. The financial consideration in the health and social sector is the return which the organization is providing to its member. The financial consideration in the health and social care sector are as follows-

Quality of service- The quality of the service which the new home care is providing plays a key financial consideration for those who are using the financial service of the company.

Access to service - The easiness at which the organization provides the service to its users also plays a key financial consideration (Page, Graves, Halton & Barnett, 2013).

Change in the staffing level- The effectiveness with which the staff of the organization deals with act as a financial consideration for the user.

4.4 Suggest financial system that can improve the service which the new health care is offering.

Assessing value for money

The manager needs to find the value which the organization is offering to the customer in relation to the price paid by the customer. The value of the services will helps the management in determining the price of the product.

Cost and unit estimation per head- The costing helps the management in ascertaining the per unit cost of the product by charging all the expenditure which are incurred on the production. It helps in determining the price which the organization needs to be charged for its product and services.

Prioritizing

The organization needs to make the changes in the product as per the requirement of the customer to deliver the quality product and service to the customer.

Conclusion

So it may be conclude that the costing helps the management to effectively manage the cost and income of the organization. It helps the management in making various decision in relation to the business and helps in attaining organization goals and objective.

References

Adane, K., Abiy, Z. & Desta, K. 2015, "The revenue generated from clinical chemistry and hematology laboratory services as determined using activity-based costing (ABC) model", Cost effectiveness and resource allocation : C/E, vol. 13, pp. 20.

Andersch, A., Buehlmann, U., Palmer, J., Wiedenbeck, J.K. & Lawser, S. 2013, "Product costing program for wood component manufacturers", Forest Products Journal, vol. 63, no. 7-8, pp. 247.

Haroun, A.E. 2015, "Maintenance cost estimation: application of activity-based costing as a fair estimate method", Journal of Quality in Maintenance Engineering, vol. 21, no. 3, pp. 258-270.

Innocent, N. & Chimezie, N. 2013, "Principles of costing and cost analysis as a tool for production costs control: a case study of Nigerian companies", Research Journal in Engineering and Applied Sciences (RJEAS), vol. 2, no. 3, pp. 225.

Linassi, R., Alberton, A. & Marinho, S.V. 2016, "Menu engineering and activity-based costing: An improved method of menu planning", International Journal of Contemporary Hospitality Management, vol. 28, no. 7, pp. 1417-1440.

Martinez-Sanchez, V., Kromann, M.A. & Astrup, T.F. 2015, "Life cycle costing of waste management systems: overview, calculation principles and case studies", Waste management (New York, N.Y.), vol. 36, pp. 343-355.

Mehdi, S. & Reza, M. 2012, "Costing management on activity based costing and economic value added in manufacturing companies in Iran", Advances in Environmental Biology, , pp. 2403.

Ozyapici, H. & Tanis, V.N. 2016, "Improving health care costing with resource consumption accounting", International Journal of Health Care Quality Assurance, vol. 29, no. 6, pp. 646-663.

Details

Other Assignments

Related Solution

Other Solution